AI Financial Advisor

Overview

Despite the high costs of retirement and college savings, only 30% of Americans have a long term financial plan.

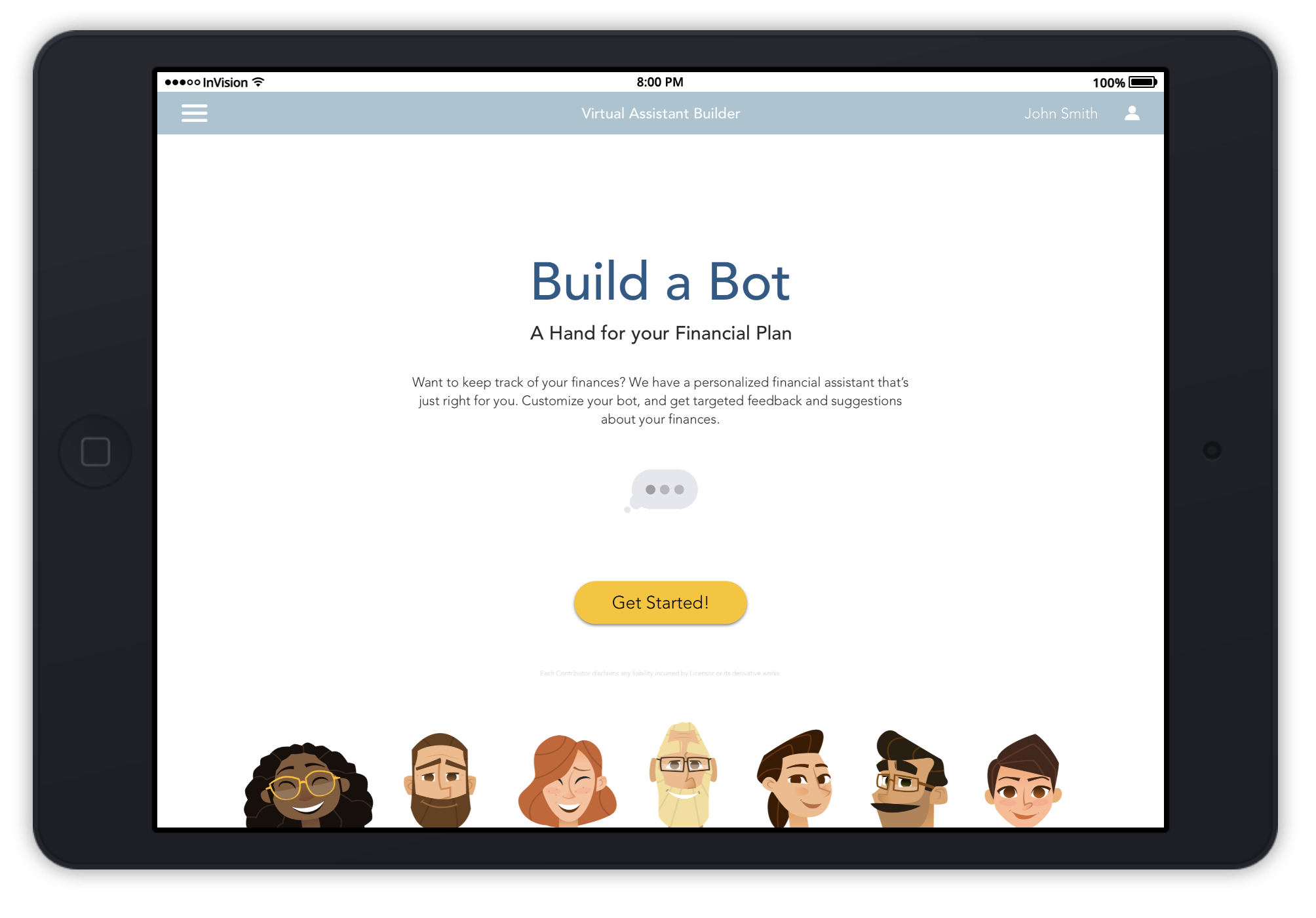

With Build a Bot, mass affluent customers can get customized support for their long term financial planning. Build a Bot is a financial advising bot that is customized and personalized to each customer’s needs.

We wanted to address the fact that financial advisers are finite, and that a Chat Bot could provide the much needed guidance customers need without straining the financial adviser. We designed Build a Bot not only for customers, but as a tool for bank staff to quickly get to know the customers, and provide more in-depth assistance in situations where the bot could not assist the customer. We see Build a Bot not only as a tool for bank customers, but also for bank employees and financial advisers.

This solution intentionally takes a playful approach and pushes the boundaries of what customers expect from their bank. Throughout our concept development, we debated the value of a “playful” tone when it came to creating the Chat Bot’s overall mood and feel. As a continuation of our concept, it would be valuable to see if a product that conveyed a more “playful” attitude was taken as seriously as a product with a more serious attitude.

Outcome

This project's goal was to provide our client, a Fortune 500 bank, with a learner experience design approach to encouraging customer savings. At the end of this project, we presented a demo of our prototype app and gave a presentation at the client's headquarters. Our clients were provided with an InVision prototype, a concept video, and a 21 page document delineating our application of learning design theory.

Concept Video

Learning Experience Approach

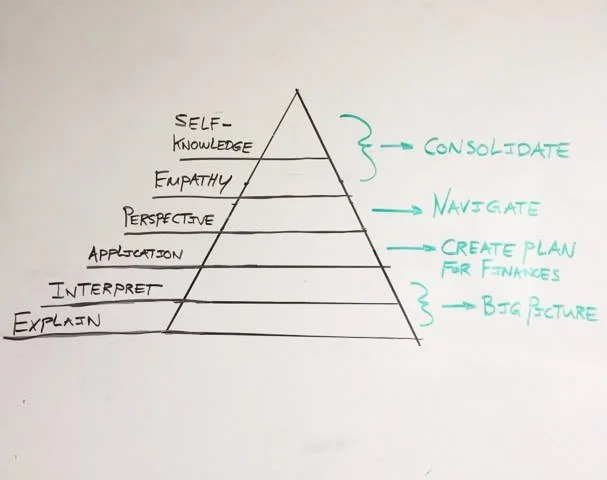

Since low financial literacy prevents many people from properly managing their finances, this project explored methods for applying learner experience theory to financial services. In developing our solution, we used Wiggins and McTighe's Six Facets of Understanding as our central theoretical framework. We used this framework as a timeline for the user's journey. For instance, in the Explain and interpret phases, the customer sees the big picture of their financial life. Then, they create a plan for their finances during which they apply their new knowledge. In the perspective and empathy phases, they learn to navigate the banking system and understand the bank’s perspective. In the final stage, they gain awareness of what they know and don’t know about their finances.

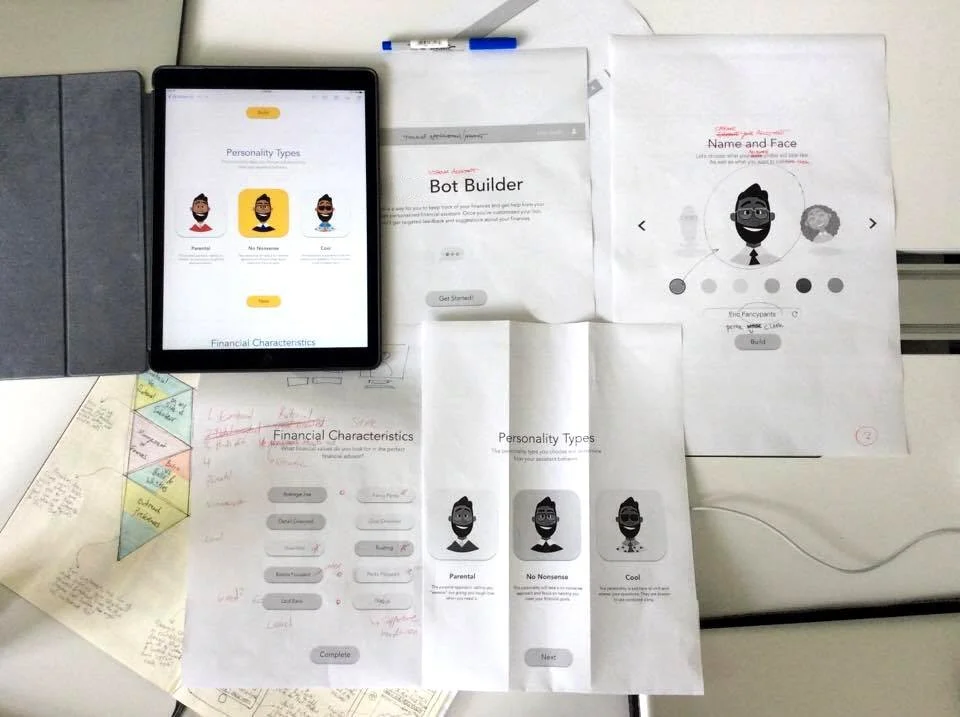

Our solution also drew heavily from Dirksen's Design for How People Learn. Specifically, our solution provides customization which scaffolds the learning experience based on the user's level of financial literacy. We also wanted to develop a solution which appeals to people's sense of play and exploration.

Ideation

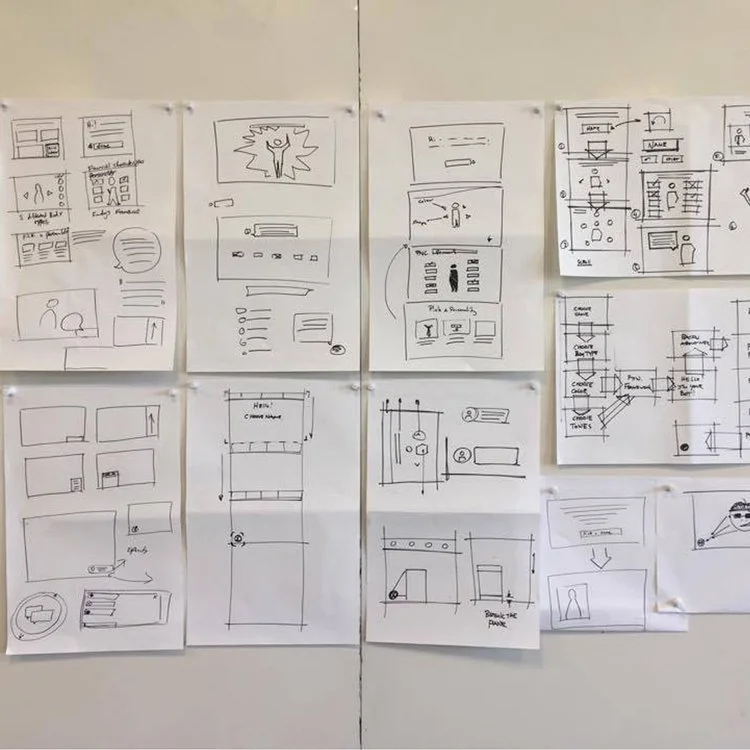

During our ideation phase, we focused on three overarching goals for the user's learning experience:

See the bigger picture of their financial life.

Create an organized, efficient plan for their finances.

Navigate the banking system independently.

In order to achieve these goals, we explored many potential mediums, such as data visualization, purchase rating systems, voice based/Alexa learning experiences, educational booths in bank branches, physical toolkits, person-to-person interactions, and a guided/game experience. Finally, we decided to explore how a customized chat bot could facilitate a couple's financial communication and provide useful financial planning information.

Solution

Our final solution includes an InVision prototype, a concept video, and a 21 page guide for the client delineating our application of learning design theory.

We wanted to address the fact that financial advisers are finite, and that a Chat Bot could provide the much needed guidance customers need without straining the financial adviser. We designed Build a Bot not only for customers, but as a tool for bank staff to quickly get to know the customers, and provide more in-depth assistance in situations where the bot could not assist the customer. We see Build a Bot not only as a tool for bank customers, but also for bank employees and financial advisers.

This solution intentionally takes a playful approach and pushes the boundaries of what customers expect from their bank. Throughout our concept development, we debated the value of a “playful” tone when it came to creating the Chat Bot’s overall mood and feel. As a continuation of our concept, it would be valuable to see if a product that conveyed a more “playful” attitude was taken as seriously as a product with a more serious attitude.